FirstFT: Google will power ads with generative AI

[ad_1]

Good day. This article is an in situ version of our FirstFT Newsletter. subscribe to our Asia, Europe/Africa either Americas edition to receive it directly in your inbox every morning from Monday to Friday

Today we have a scoop on Google’s plans to Introducing Generative Artificial Intelligence Into Your Advertising Business in the coming months, in the latest move by tech giants to incorporate innovative technology into their products.

According to an internal presentation to advertisers seen by the Financial Times, the Alphabet-owned company intends to start using AI to create novel ads based on materials produced by human marketers.

Google already uses AI in its advertising business to create simple ads that encourage users to buy products. However, the integration of its latest generative AI, which also powers its Bard chatbot, means it will be able to produce much more sophisticated campaigns that resemble those created by marketing agencies.

Depending on the presentation, advertisers can provide “creative” content, such as images, videos, and text related to a particular campaign. The AI will then “remix” this material to generate ads based on the audience you’re trying to reach, as well as other goals, such as sales targets.

This is what I’m checking today:

-

ECB: The European Central Bank publishes the monetary policy discussions of its meeting held last month.

-

UNITED KINGDOM: The CBI and PwC release their quarterly survey of financial services, tracking optimism, earnings and employment for the first quarter.

-

Results: Report by WHSmith, Ipsos, Renault, AT&T, American Express and Philip Morris International.

Five more main stories

1. EXCLUSIVE: Bank of America has raised concerns with Lloyd’s of London about the exclusion of “state-backed” cyberattacks. of standard insurance policies, underscoring concerns among financial institutions about changes to a crucial safety net. Read the full story.

-

More banks: The head of Morgan Stanley has warned that investment banking income may not recover until next year after the group reported a drop in earnings.

-

Opinion: The banks are now watching well positioned to overcome as well as some in the market have considered that they cannot be invested, writes the founder of Algebris Investments, Davide Serra.

2. Pension funds have urged UK Chancellor Jeremy Hunt not to force them to invest in riskier assets. as young and fast growing British companies and infrastructure. Hunt has said he would not be “instinctively comfortable” directing pension funds where to invest some of their money. but has not ruled out such a move.

3. Virgin Media O2 has initiated the sale of at least half of its stake in Cornerstone, which runs the UK’s largest mobile tower network and is likely to be valued at up to £3bn. Here’s how Virgin Media O2 could use the money from the sale.

4. Elon Musk indicated he was willing to sacrifice Tesla’s short-term profits for market share to earn more money later when the company cars can function as fully autonomous “robotaxis”. The unconventional justification sent shares down 6 percent in aftermarket trading yesterday.

5. The EU is planning emergency restrictions on grain imports from Ukraine to five member states close to the war-torn country, bowing to pressure from Poland and Hungary after they took unilateral steps to protect local farmers from cheap imports. Read more about Brussels’ unusual response to a challenge to its trade policy powers.

the great read

© FT Montage/Reuters

With India poised to overtake China as the world’s most populous country, its public digital infrastructure has become a central part of Prime Minister Narendra Modi’s efforts to present India as a rising economic superpower and alternative investment destination. for your neighbor. But the “India Stack”, its novel approach to integrating public and private digital services, has raised concerns about privacy and data protection.

We are also reading. . .

chart of the day

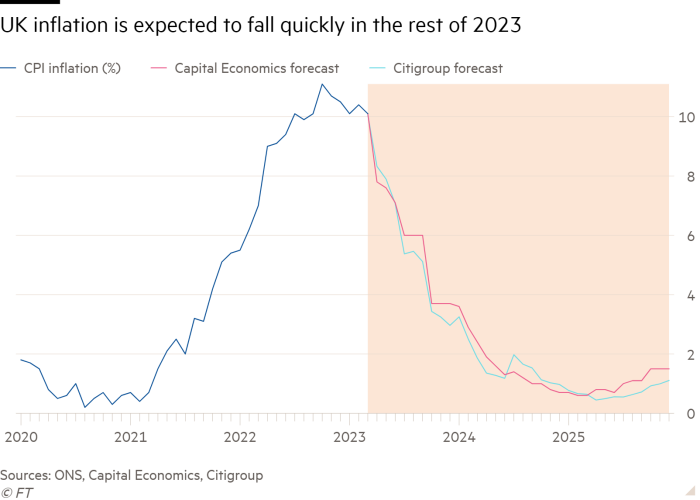

Data released yesterday showed UK inflation fell less than expected and held in double digits at 10.1 percent last month, significantly higher than in the US and the eurozone. But the details and underlying trends also indicate that Britain is not the outlier initial comparisons suggest.

Take a break from the news

Double Vanilla is a street style vlogger who asks strangers to detail their looks and asks for their price. On a trip to Paris, he interviewed a tourist wearing Tom Ford sunglasses, a Dior bag, Chanel sneakers and Van Cleef & Arpels jewelry and was able to reveal the Not inconsiderable sum for his set of “walking through Paris with my daughter.”

“People are always interested in seeing how much other people are spending on their clothes,” says Double Vanilla.

Additional contributions by Gordon Smith and Emily Goldberg

Thanks for reading and remember that you can add FirstFT to my FT You can also choose to receive a push notification from FirstFT every morning in the app. Send your recommendations and comments to firstft@ft.com

[ad_2]