The stubborn UK inflation rate is forecast to lose steam in the coming months

[ad_1]

The latest inflation data from the UK have called into question the strategy of ministers and the Bank of England to reduce price growth.

With official figures on Wednesday showing Britain’s inflation rate falling less than expected and holding in double digits in 10.1 percent in MarchUK price growth was significantly higher than UK price growth. eurozonewhich fell sharply to 6.9 percent, and the US, which fell to 5 percent in the same month.

But while the details and underlying trends were not entirely reassuring, they also suggest that the UK is not the outlier initial comparisons suggest.

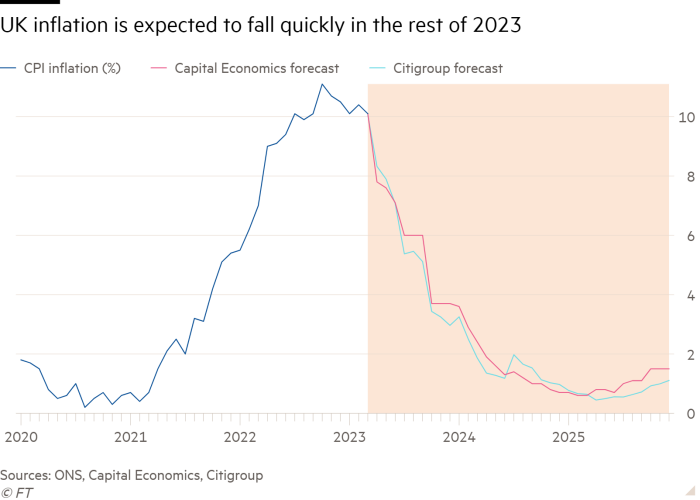

Prime Minister Rishi Sunak and his Foreign Minister Jeremy Hunt are very likely to meet its commitment to cut inflation in half by the end of the year, say economists.

Sunak made the commitment in early January, when the headline inflation rate was 10.7 percent. New projections on Wednesday from Capital Economics, the consultancy, and Citigroup, the investment bank, put the rate for December 2023 at 3.7 percent and 3 percent, respectively, easily meeting the prime minister’s target.

in Treasury Monthly summary Of the economic forecasts, also published on Wednesday, only four of the 27 UK forecasters predicted that CPI inflation would exceed the government’s promise and be above 5.4 percent for the fourth quarter of this year.

The reason behind the rapid drop in the inflation rate is that by this summer, gas and electricity prices will be lower than last year, and wholesale gas prices will fall nearly 85 percent from their peak in last august.

Paul Dales, chief UK economist at Capital Economics, said that while ministers would take credit for falling inflation, they would not have contributed to it. “The best goal you are going to set is one that you can achieve without doing anything,” he said.

Energy currently contributes 3.5 percentage points to the 10.1% inflation figure, and is set to disappear by the end of the year. The first big drop in inflation is expected in next month’s data, with the headline rate expected to decline by around 2 percentage points in a single month.

Comparison of UK inflation with rates in other countries has been complicated over the past year by differing energy subsidy schemes across Europe, by the extent to which households directly or indirectly consume natural gas for space heating household and electricity generation, more due to the weight of food in the national inflation rates.

This has meant that inflation in the eurozone has been highest in the Baltic states (Estonia, Latvia and Lithuania) and Slovakia, with rates significantly higher than in the UK. The faster decline in wholesale energy prices in other countries, notably Spain and Germany, has helped drive down the headline rate in the eurozone more quickly than in the UK.

However, the euro area still does not have inflation under control and its core rate (excluding energy, food, alcohol and tobacco) held steady at 5.7 percent in March, similar to the core rate of 6.2 percent in the United Kingdom. The US core rate increased from 5.5 percent in February to 5.6 percent in March.

Many economists think that UK and eurozone inflation are essentially similar and too high for comfort. In separate notes on Wednesday, Philip Rush, founder of consultancy Heteronomics, said there were still “excessive” underlying inflationary pressures in both.

But economists are more concerned with UK labor market and wages, which continue to worry the Bank of England. Although the definitions and time periods differ somewhat, the 6.9% annual growth in UK private sector wages is higher than the Eurozone corporate sector wage increase of 5.2% and 4 .2% observed in the US

Andrew Bailey, the Governor of the BoE, has pointed repeatedly that wages are a key concern of the bank’s rate-setting Monetary Policy Committee, and that the performance of the UK labor market is “unique” in some areas, particularly given the number of older people who have left the labor market since the pandemic.

Dales said that with labor force participation issues related to poor health and problems in the SNS“we feel these [unique UK] the problems will stay longer.”

Economists also point out that although UK inflation will fall and its core rate is not much higher than in the eurozone or the US, the BoE should be concerned that inflation falling to around 4 percent is not what same as the lasting return of price increases to the BoE’s target of 2 percent.

There are almost 270 individual items included in the UK inflation calculation; the share of those with inflation rates above 5 percent has risen in recent months from 28.6 percent to over 35 percent, indicating amplification of price pressures.

While most forecasters believe UK inflation will fall below 2% through 2024, economists also believe the central bank will need to raise interest rates above the current 4.25% to achieve this.

Financial markets have priced in a quarter-point rate hike for May and more hikes to bring the rate to 5 percent by the end of the year.

These increases, if they occur, would create a recessionary force in the UK economy, which would exacerbate cost of living pressuresespecially for people with mortgages nearing the end of a fixed rate period.

Against that, most economists have been revising their UK economic growth forecasts this year because cheaper energy prices will ease some of the stress on households and allow for more non-inflationary economic growth.

The BoE’s difficult job will be balancing these forces and trying to determine how much interest rates need to rise to stifle price rises.

Few are confident of forecasting the way forward when inflation has reached 40-year highs in many countries, but economists on Wednesday were almost in agreement that the central bank will raise rates again on May 11.

Paula Bejarano Carbo, associate economist at the National Institute for Economic and Social Research, said the only thing that was clear about the UK economy now was that “inflationary pressures remain persistent”.

[ad_2]