When, where and for how long

[ad_1]

If you spend any time with FinTV, even if it’s muted in the background, you would have been invited into a discussion about “Are we in a new bull market?” Or not. Sometimes it is expressed as “Is the bear market over?”

I think this is the wrong way to think about bull and bear markets.

We have previously discussed (see this, this, thisand this) why the 20% bullish/bearish framework is just loud nonsense. It’s a nonsensical media creation fiction, a rule of thumb with no evidence to show it’s meaningful.1 (beyond the fact that we have so many fingers and toes). But there are many other good reasons to avoid the “Buy now, no, sell now” debate: First, few are good at picking bottoms and tops; Second, no one should manage “real” money.2 that way, since the costs of being wrong are simply too high. Third, it’s an approach that generally lacks the kind of process essential to a good investment.

Good investors understand that bear markets and volatility are part of the source of returns; these long-term investors have learned that riding them is their most likely approach.3

You may find it helpful to think of Bull/Bear discussions in terms of context: When, Whereand to How long.

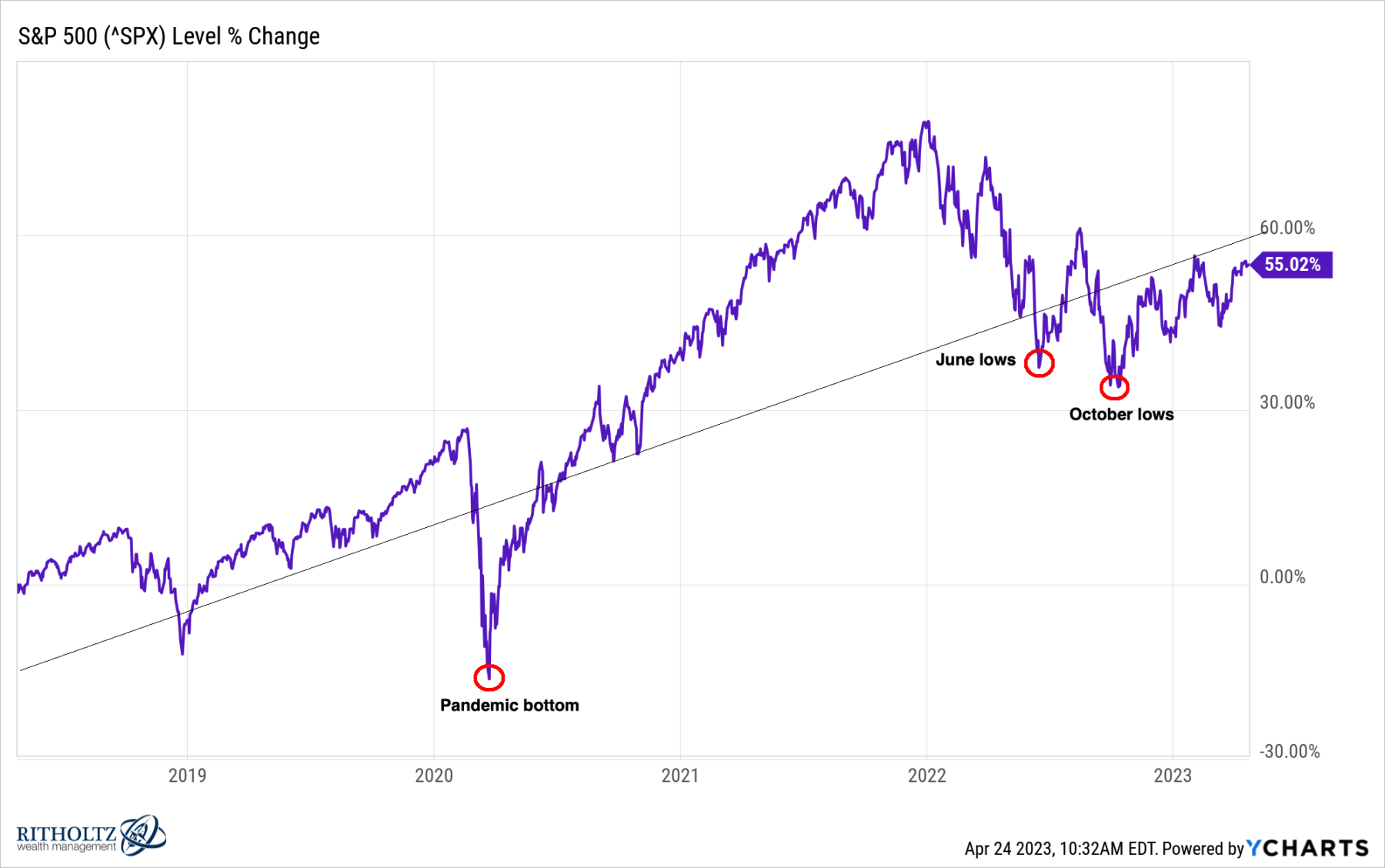

When: Framing the “when” question is simply asking what the larger time frame is around any particular market move. Is a pullback taking place in the context of a larger move up? Is this a bounce in the middle of a relentless downward slide? Understanding the larger context of when this move occurs is helpful in understanding the odds of it continuing.

Markets are like fractals, and what you see often depends on the time frame you are using. You can find very different conclusions if you focus on minutes, days, weeks, months, quarters, years, or decades. A substantial part of market discussions seems to be people with different time horizons talking to each other. The time periods I find useful are secular market movements that can last for decades, and cyclical movements that last for months.

Where: In this morning readI referenced JC Paret’s discussion of overseas earnings. When people complain that they are in a bear market, we must recognize that they are often exhibiting “country of origin bias.” Just because your local stock market is down doesn’t mean all the world’s stock markets are down too. As JC pointed out: “It’s not the bull market’s fault that your country is underperforming.”

In fact, geographic diversification often means that various stock holdings behave differently. Consider 4 geographic regions: the US, the developed world without the US, emerging markets, and the frontier. Everyone has different sensitivities to economic factors such as trade, inflation, commodities, and growth. Within the stock portion of their portfolios, they can provide some measure of diversification.

How long: My favorite context for thinking about markets is that long-term secular bull and bear markets are the word “secular.”

TO secular bull market it is an extended period of time (10-20 years) driven by broad economic changes that create an environment conducive to increasing corporate revenues and profits. Its most dominant feature is the increasing willingness of investors to pay more and more for a dollar of earnings. Secular bear markets are not as long lasting, they are more violent, but otherwise they are the flip side of a bull.

But understanding when we’re in a secular bull market might give you better context for thinking about risk and managing your own behavior in relation to turmoil.

One of the subtexts of the above is that for the vast majority of investors, Martin GabelThe “Don’t just do something, sit there” admonition is usually your best approach.

Markets are complex mechanisms. Oversimplifying them into narratives or relying on context-free myths will not serve your portfolio well.

Previously:

Observations to Beginning 2023 (January 3, 2023)

Hitting bottom? (December 1, 2022)

Secular vs. Cyclical Markets, 2022 (May 16, 2022)

bullish bull market (March 31, 2021)

Redefining Bull and Bear Markets (August 14, 2017)

Are we in a secular bull market? (November 4, 2016)

__________

1. If you want to read more about why 20% is not significant.

2. Real in terms of importance to investors and size. No one should be moving billions of dollars based on gut feeling, and certainly not retirement accounts or other major capital.

3. Note that we haven’t even referenced the valuation debate.

[ad_2]